The Value of Cash

Cash is king, especially when asset prices are deflating.

This year’s bear market in stocks has gone according to script. It started (last year in many indices) with hardly anybody believing that stocks could decline and that the relentless advance would continue. Then, as stocks continued to decline, the “buy-the-dip” mob emerged, convinced that the swoon was temporary, and that normal bull market service will be resumed shortly. Now, with no recovery and continued downward pressure on equities, it seems many people are trying to justify why stocks will continue to decline, the ongoing rise in interest rates being the main reason. Although sentiment is nowhere near as bearish as it will be at the true bottom, previous bulls are becoming bears.

Take the founder of the world’s largest hedge fund. We have featured his comments about cash as an investment choice before, and he has just entered the fray again.

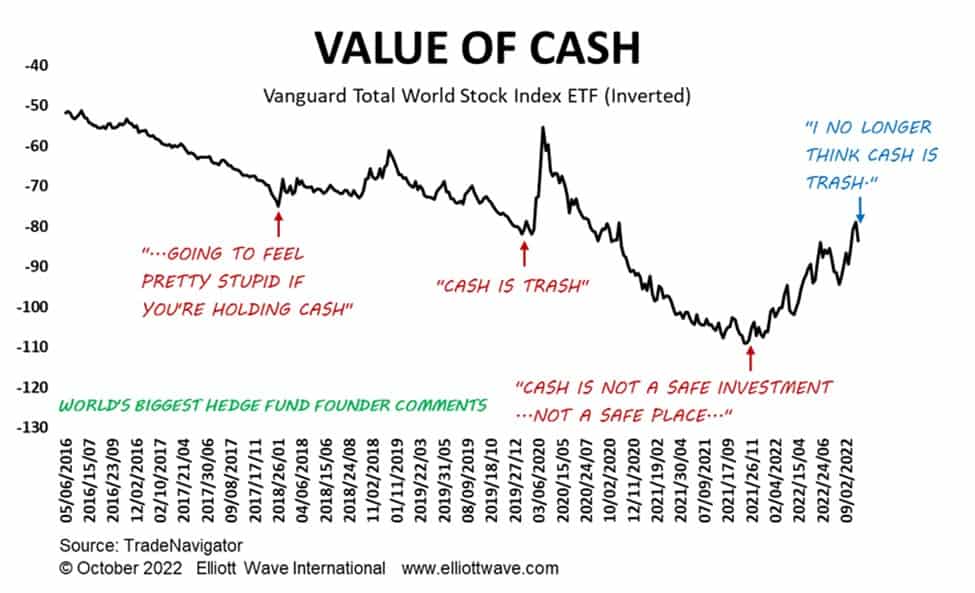

The chart below shows the inverted price of the world stock market index as proxied by the Vanguard ETF, ticker VT. By turning a stock market chart upside down, it essentially gives us a chart showing the value of cash. As stocks advance (the chart goes down), the value of cash declines. But as stocks decline (the chart goes up), the value of cash increases as you can buy more shares with your liquidity.

As you can see, anti-cash comments hit the headlines in January 2018, January 2020, and December 2021, AFTER a downtrend in the value of cash and pretty much nailing lows in the chart. That is, a TOP in the stock market.

Now, though, our cash-spokesperson-indicator has flipped and decided that cash is no longer trash after all. This is consistent in that it is coming AFTER the value of cash has experienced an uptrend this year as stocks have deflated. Will this latest comment mean that the value of cash now declines, and stock markets continue to bounce? It’s going to be fascinating to find out.