U.S. Consumers Tapped Out

This trend points to debt deflation.

We’ve said it before, but U.S. consumers are the lynchpin of the global economy being, as they are, so vital to the performance of the largest economy on the planet. Keeping an eye on what the U.S. consumer is doing therefore makes a lot of sense.

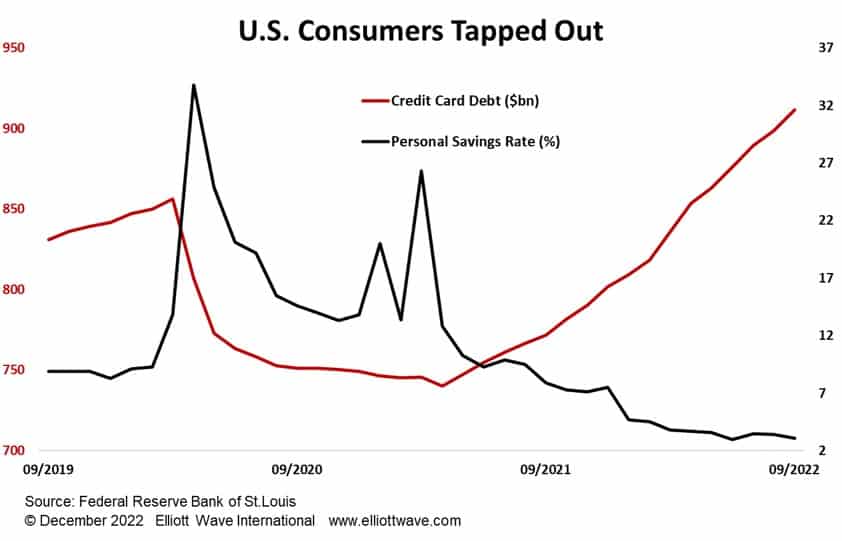

The chart below shows the personal savings rate for U.S. households as well as the level of credit card debt. The savings rate spiked higher during 2020 due to pandemic-induced economic lockdowns as well as the fact that the Fed’s helicopters dropped money outside everyone’s home (those “stimy checks” will become infamous in financial history). Credit card debt declined in 2020 and into 2021 as the U.S. consumer spent this cash pile.

However, since the middle of 2021 the savings rate has continued to decline whilst credit card debt has ramped up markedly. The savings rate is now near an all-time low whilst credit card debt is at an all-time high. Clearly, U.S. consumers are, in aggregate, flying very close to the sun.

The key is employment. Thus far, the labor market has not come under any strain but there are signs that it is beginning to wobble. Should unemployment start to rise, as seems likely in 2023, credit card debt will deflate, and the savings rate will rise. In those circumstances, the U.S. and the global economy will be in dire straits (and U.S. consumers will not be getting their money for nothin’).