Unintended Consequences – The Fed’s Monster

When too much cash becomes a problem.

Chief executives from the biggest banks in the U.S. faced their annual grilling in Congress this week, when politicians get to roast them, or not, according to their own political agenda. Nothing gets resolved, it’s merely pantomime. However, it does enable some topics to come to light and, currently, the banks are worried about increasing regulation. The ever-increasing capital requirements that some banks are facing is curtailing lending in the economy, according to JP Morgan boss, Jamie Dimon.

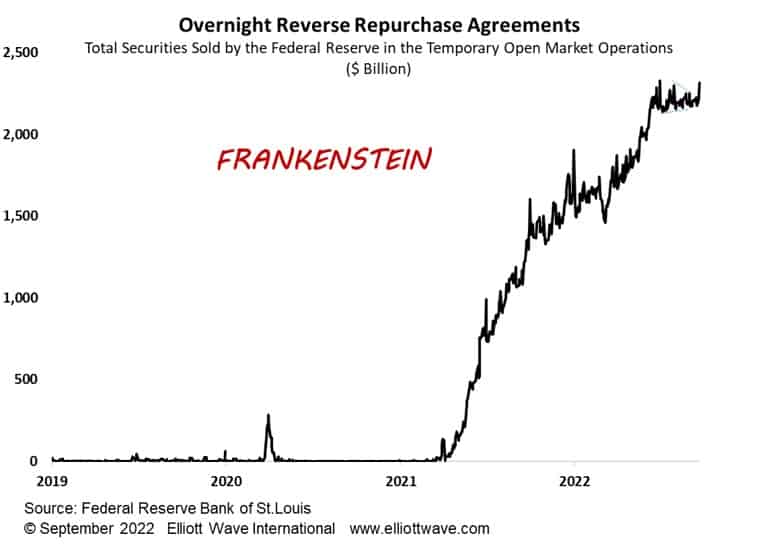

Not only are banks having to set aside extra capital that can’t be used for lending, they are also facing a dwindling deposit base. Investors are increasingly taking cash away from banks and putting it into money market funds. A major reason for this is that the banks pay investors below what money market funds can get using the Fed’s Reverse Repo facility. As the chart below shows, the Reverse Repo usage exploded higher last year as, thanks to the Fed’s money printing, institutions had nowhere else to put their cash.

However, usage has continued to grow, despite the Fed beginning to tighten monetary policy. This reflects the fact that money market funds have been taking deposits away from the banks, and this is another barrier to banks’ ability to extend finance in the economy. It’s as if the Fed, by its unprecedented, gargantuan money printing has created a Frankenstein-like monster with the unintended consequence of actually impeding the wheels of finance.

Elliott wavers might spot a distinct triangle on this chart. That could mean that the current upward thrust in Reverse Repo usage is the last and that a top is nearby. When Reverse Repo usage starts to decline, as it will, and begins to return back to historically normal levels of not much above zero, it will be a sure sign that the era of free money is over, and that deflation is occurring.