Would the Real Fed Funds Please Stand Up?

This Fed probably wants to get back to normal.

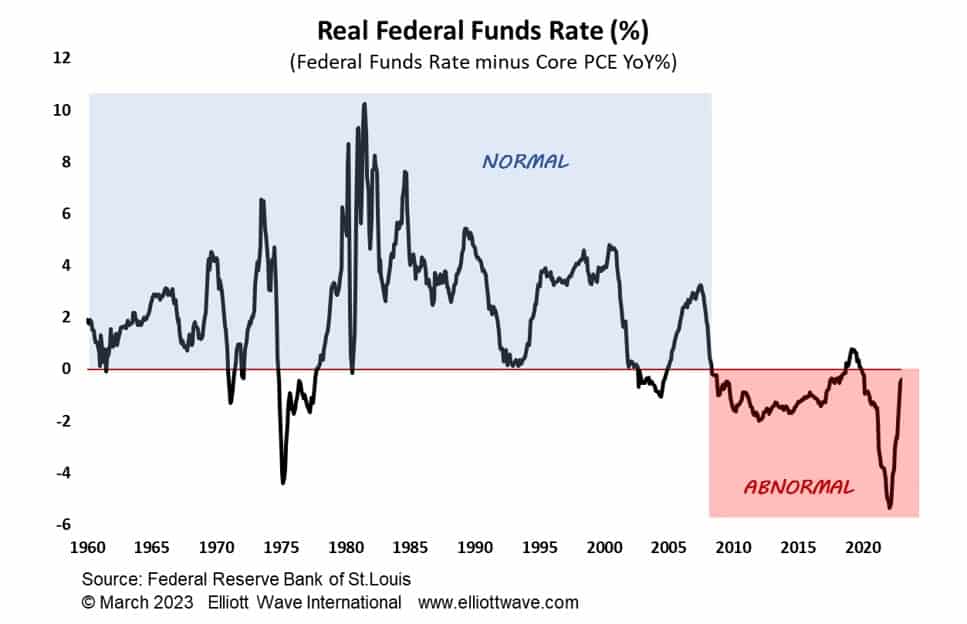

The chart below shows just how strange the last fifteen years have been in the financial world. The “real” Federal Funds rate can be measured in a few ways. This one takes the Federal Funds rate (the central bank’s policy rate) minus the annualized rate of change in the Core PCE series. That stands for Personal Consumption Expenditures Excluding Food and Energy. A bit of a mouthful so that’s why Core PCE will suffice.

The chart shows that from 1960 to the Great Financial Crisis of 2008, the Fed Funds rate was normally above the Core PCE annualized rate, meaning that the “real” Fed Funds rate was positive. Since 2008, though, the Fed Funds rate has been abnormally below the Core PCE rate, meaning that the real Fed Funds rate has been negative.

Core PCE is the Fed’s preferred measurement of consumer price inflation and the current Fed is hell-bent on snuffing out its fast pace. Rightly or wrongly (we think wrongly), the Fed thinks the main tool in achieving that aim is to raise the level of the Fed Funds rate. Given the history, there can be little doubt that the Fed will want, at a minimum, the level of Fed Funds to be above the annualized rate of Core PCE.

As the chart shows, that will require at least another 50-basis points of rate hikes by the Fed as things currently stand. Of course, should Core PCE accelerate, the Fed will think that it needs to do more.

This Fed is being likened to the Volcker Fed of the 1970s / 80s. Don’t make me laugh. Look at the level of real Fed Funds back then, reaching a peak of 10% in 1981. That same dynamic now would mean that the nominal Fed Funds rate should be around 15%!

If Jay Powell really does want to emulate Paul Volcker, the Fed Funds rate has much, much higher to go.