Bank Employees Fear Layoffs as Mortgage Volumes Nosedive

The deflation of the housing boom has employees at a major U.S. bank worried about their jobs.

Here’s a Nov. 2 CNBC headline:

Wells Fargo mortgage staff brace for layoffs as U.S. loan volumes collapse

Get this: The volume of mortgages is down about 90% from just a year earlier. As the article notes, this big slowdown has left some of those on the mortgage staff with little to do.

Elliott Wave International sees evidence that this is only the beginning of another housing bust.

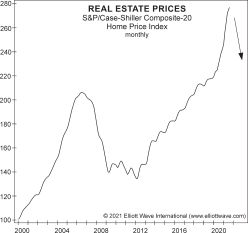

Review this chart and commentary from Robert Prechter’s book, Last Chance to Conquer the Crash:

Although real estate prices on average exceeded their 2006 highs, the recovery has been thin, as housing starts have slackened and transaction volume is down. Underlying weakness in a recovery is characteristic of terminal advances.

The next wave down in real estate prices will be even deeper and more prolonged than that of 2006-2012. When the institutional investors who bought properties in bulk finally give up on their holdings, there will be a glut of homes on the market, which will contribute to the price decline. In a few years, much of the newest batch of mortgage debt will become worthless.