China Evergrande Group Declared in Default

It’s been all over the news that China Evergrande Group, the world’s most indebted property developer, failed to make two coupon payments to bondholders by a designated deadline.

Thus, this Dec. 9 headline (CBS News):

Evergrande defaults on $1.2B in foreign bonds …

This is no surprise to Elliott Wave International.

As far back as June 30, 2017, the monthly Elliott Wave Financial Forecast warned about China Evergrande’s debt levels:

From 2011 to 2016, China Evergrande’s assets grew 750% to make it mainland China’s second largest property developer. Along the way, the firm accumulated a debt to common equity ratio of 1209.5%. The average of the same ratio in 10 different U.S. home builders is 80%. The figure is understated, as it does not reflect the company’s $6.6 billion international bond offering last week.

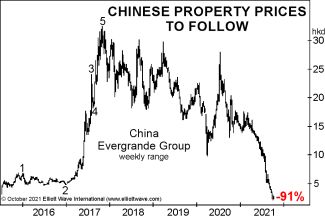

Fast forward to the Oct. 1, 2021 issue of EWFF, which showed this chart and reflected back on its June 30, 2017 commentary:

As the chart shows, the market has already rendered its verdict with respect to China Evergrande’s solvency. The company’s share price is down 91% from its peak, and its bonds are selling for 24 cents on the dollar. In 2017, EWFF stated, “China Evergrande’s ‘Teflon’ appears ready to dissolve.” Four years later, it has.