China’s Dollar Junk Yields Soar: Global Financial Trouble Ahead?

Debt investors demand higher yields when they perceive an increased risk of defaults. This is a sign of a developing deflationary psychology.

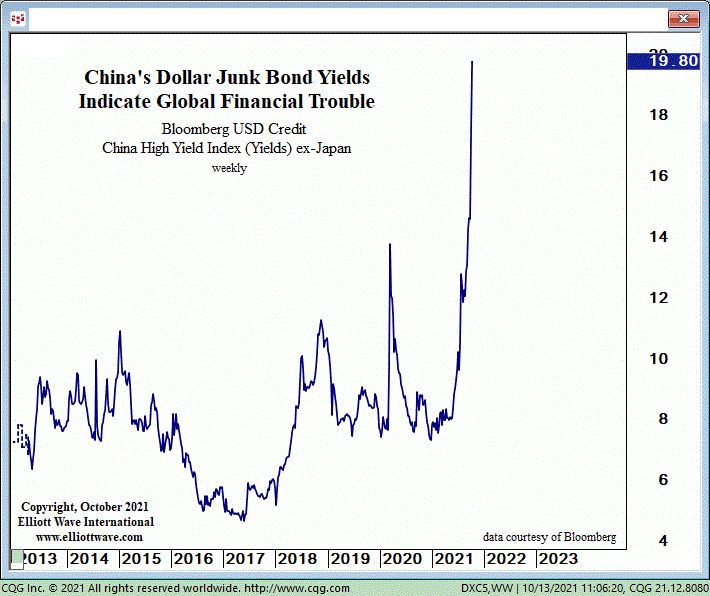

With that in mind, China’s dollar junk yields have reached a whopping 20%.

So far, however – Bloomberg says these ramped up default worries are mainly confined to China.

Here’s an excerpt from an Oct. 15 article:

The highest yields in a decade for Chinese junk bonds are not fazing global credit markets.

While contagion risk fears over China Evergrande Group’s deepening liquidity crisis are sending yields on the country’s riskier notes soaring to 20%, other debt markets are so far showing relative calm.

Yields on the broader pool of junk-rated emerging market debt and CCC rated U.S. bonds have been steadier, even as sliding bond prices send yields on Chinese dollar junk notes — a sector dominated by property developers — ever higher.

However, Elliott Wave International’s thrice weekly U.S. Short Term Update sees China’s soaring dollar junk yields as a big global warning sign.

Here’s a chart and commentary from the Oct. 13 U.S. Short Term Update (which published when China’s U.S. dollar junk bond yields were just below 20%):

The chart shows the yield on China’s U.S. dollar junk bonds, which are soaring. Since October 1, the day we published [the October issue of the monthly Elliott Wave Financial Forecast], China junk bond yields have shot up from 14.7% to nearly 19.80%, a 35% increase, reflecting the deepening debt crisis that is squashing liquidity. It’s spreading. Besides the de facto bankruptcy of China Evergrande, last week there was a “surprise” default in Fantasia Holdings Group, another Chinese property developer. And EWFF noted the whopping plunge in the shares of Sinic Holdings, yet another Chinese real estate development company. The stock dropped 87% in one day and trading was suspended. After declining to a record low 3.53% on July 6, U.S. junk bond yields just made a new seven-month high, rising 21% to yield 4.27%. This is just the start, in our opinion. Yet there appears to be a complete lack of recognition by investors as to the significance of diminishing liquidity trends in world credit markets. As the bear market progresses, U.S. junk bond yields will eventually resemble China’s junk bond yields as world credit evaporates. The contagion will then spread to higher-grade credits. It’s how bear markets operate.