Conglomerate in China Faces Mounting Deflationary Pressure

Fosun International Limited, a multinational conglomerate headquartered in Shanghai, is selling off assets as it faces a major debt crisis.

Here’s an October 20 Financial Times headline:

Fosun divestments near $5bn as debt pressure mounts

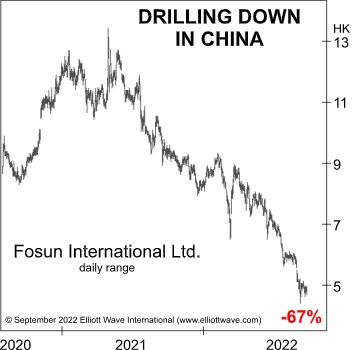

At the same time, the conglomerate’s share price has tumbled.

The October Elliott Wave Financial Forecast showed this chart and said:

This chart shows Fosun’s 67% decline from May 2021. In the face of “refinancing uncertainties,” the yield on Fosun’s dollar debt is above 30%. After being downgraded by Moody’s in late August, the company said it will cut costs and sell assets. In other words, deflationary pressure is mounting. The more Fosun and others try to dig themselves out, the more intense those pressures will become, and the harder their debts will be to repay.

Fosun’s woes are reflective of China’s larger economic issues.

Three weeks after the October Elliott Wave Financial Forecast published, Fosun’s shares are trading even lower.