“Contraction is Underway” in China

It’s common in China for people to start paying a mortgage before the construction of an apartment or home is complete.

However, there have been big delays in completing building projects. On top of that, real estate values have been sinking.

Homebuyers in at least 80 Chinese cities are fed up. Here’s a July 18 Fortune headline:

The great Chinese mortgage strike: Thousands of homebuyers are refusing to pay their home loans as growing boycotts spread online

The real estate sector makes up close to 24% of China’s GDP, so turmoil in real estate means trouble for the entire economy.

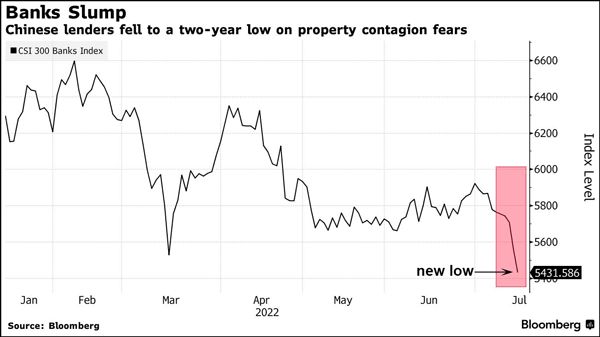

The July Elliott Wave Theorist, a monthly Elliott Wave International publication since 1979, showed this chart and said:

Page 1 [of the July Theorist] suggested the possibility that U.S. mortgage payers might just walk away from their obligations one day. It’s already happening in China.

The Elliott Wave Financial Forecast (another Elliott Wave International monthly publication) has consistently warned that China’s financial situation—especially as it relates to real estate values and property loans—is precarious. Bonds issued by developers have been falling all year and are now trading at 20 to 40 cents on the dollar. … This week’s new low in Chinese bank stocks (above) further confirms that a contraction is underway.

Why is it happening? Mortgage payments are the basis of banks’ income. When people stop making mortgage payments, banks lose money. China is now dealing with a nascent “stop paying mortgage” movement: