Deflationary Forces at Work in Hungary and the Czech Republic

When governments transition from excessive spending to frugality, that’s a sign of a developing deflationary psychology.

Consider a recent “surprise announcement” by Hungary’s prime minister (Dec. 14, Bloomberg):

Hungary will delay the purchase of Budapest Airport because of a ballooning budget deficit, Prime Minister Viktor Orban said.

In the same neighborhood of Europe, a cautionary financial mindset is also evidenced (Jan. 6, Reuters):

New Czech government plans cuts after budget deficit hits record

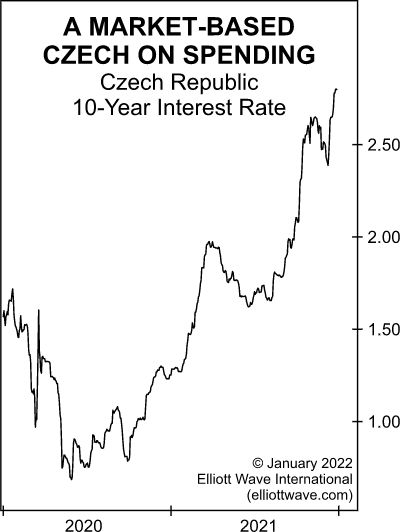

Elliott Wave International’s January Global Market Perspective offered commentary, along with this chart:

In December, the incoming [Czech government] coalition pledged to “re-write the 2022 state budget to slash billions of dollars in spending and cut the deficit.” (Reuters, 12/7/21) Ten-year borrowing costs in the country have pushed steadily higher for more than a year. … Fiscal conservatives have applauded the new administration’s apparent proactive move, but, in our view, it’s the markets that are forcing the government’s hand.

Eventually, the twin forces of rising interest rates and mounting public anger will force all European governments to massively curtail spending.