Europe Braces for Serious Economic Slump

European consumers haven’t been very happy.

Indeed, consumer confidence tumbled to its lowest level ever in September, according to the European Commission.

It’s climbed some since then, even so, there’s this Nov. 16 headline (CNBC):

Euro zone predicted to have a deep recession and a difficult, slow recovery

The chief economist for an investment bank in Germany opined that the Continent’s economy will show deterioration in Q4 2022 and Q1 2023.

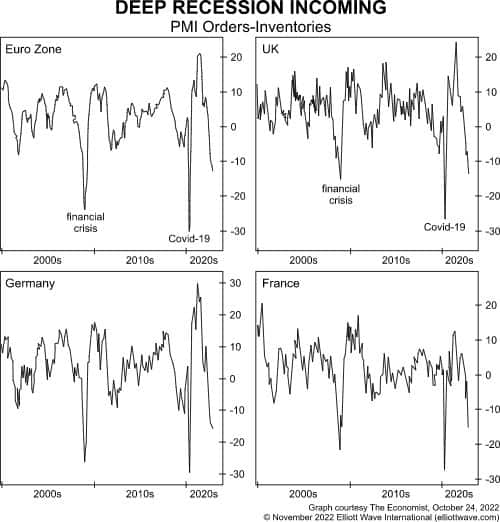

Elliott Wave International’s monthly Global Market Perspective has been keeping track of Europe’s economy. Here’s a chart and commentary from the November issue:

The power of the new bear market is also clearly visible outside of the stock market. In manufacturing, for example, economists tend to view orders minus inventories as a forward-looking gauge of economic performance. The view makes sense, because if orders increase amidst low inventory, manufacturers will need to ramp up production to meet demand. The problem is that manufacturers ride around on the same waves of optimism and pessimism that get reflected first in stock prices, which is why orders-inventories are now deeply negative in the UK, Germany, France, and the eurozone. In fact, the only two weaker readings in the past 20 years occurred when the global financial crisis hit in late 2008, and when the world’s economies closed in early 2020. Here, too, we believe that these low-water marks will be surpassed before the bear market is over.