Expect a Continued Deflation in Unicorn Company Funding

As you may know, a “unicorn” company is a term used in the venture capital industry to refer to a privately held startup with a value of over $1 billion.

There were a record number of them in 2021, but a big shift appears to be underway. Here’s a Dec. 21 news item from bizjournals.com:

Where did the unicorns go? $1B startups are getting harder to find

The pace of new $1 billion startups has “fallen precipitously in recent months” … and the trend is likely to continue

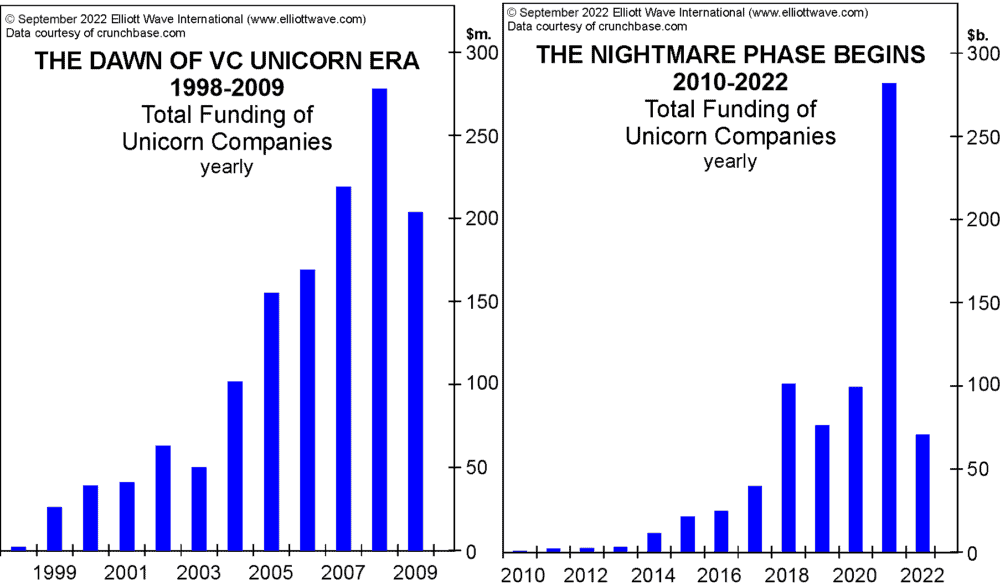

The headline and subhead line reflect what the Elliott Wave Financial Forecast said some three months ago. Here’s a chart and commentary from the October issue:

The first chart below shows the extent of unicorn funding from their inception in 1998 through the end of 2009, which included the bull market that topped in 2007. The total peaked at $277 million in 2008. The next chart shows what has happened since then. Record funding shot up to $281 billion in 2021, more than 1,000 times the 2008 peak! … In 2022, unicorns have raised $70 billion so far. … In the bear market, unicorns will go extinct, and it will last a very long time.