Famous Stock Picker Says Economy is Already in Recession

New York Federal Reserve president John Williams recently said that the economy is slowing but an official recession may not be in the cards.

However, well-known money manager Cathie Wood of ARK Invest has taken a different stance.

This June 28 Marketwatch headline sums it up:

Cathie Wood warns U.S. is already in a recession

A recession is defined as two consecutive quarters of declining GDP. U.S. GDP declined by 1.6% in Q1 (yes, revised downward –again) and economic observers now await the official data for Q2.

Elliott Wave International looks to the stock market as the best economic indicator. In other words, the economy follows the stock market.

The stock market has been in a downtrend so a recession (or worse) would not be surprising.

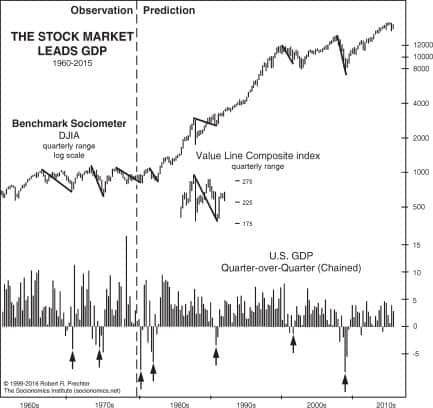

This chart and commentary from Robert Prechter’s landmark book, The Socionomic Theory of Finance, provide insight:

As the stock market fell in Q1 1980 and again in 1981-1982, back-to-back recessions developed. As the stock market rose from 1982 to 1987, an economic boom occurred. After stock prices went sideways to down from 1987 to 1990, a recession developed. As stock prices resumed rising, the economy resumed expanding. As the stock market fell in 2000-2001, a recession developed. As the stock market recovered in 2002-2007, an economic expansion occurred. As the stock market fell in 2007-2009, a recession developed, and it was commensurate with the size of the drop: The largest stock market decline since 1929-1932 led to the deepest recession since 1929-1933. As the stock market has recovered since 2009, an economic expansion has developed. In all cases but one, the stock market either turned down before the recession began or turned up before the expansion began. The lone exception was in 2002, when the Dow made a new low after the official end of the recession in 2001. Data show that a setback in GDP growth into that later bottom just barely missed creating a recessionary quarter. (It is important to understand that socionomic causality does not predict that each stock market decline will produce an official recession as defined by the NBER; it predicts that stock market declines and advances will reliably lead rather than follow whatever official recessions and recoveries do occur.