Has the Historic “Credit Boom” Reached a Peak?

You may be aware that some online retailers offer “buy now, pay later” loans (BNPL loans) for the financing of purchases.

These popular loans, especially short-term ones, have not been reported to credit bureaus. However, change is afoot.

Here’s the latest news (CNBC, March 20):

Transunion, Equifax and Experian have announced plans to include BNPL loans on credit reports.

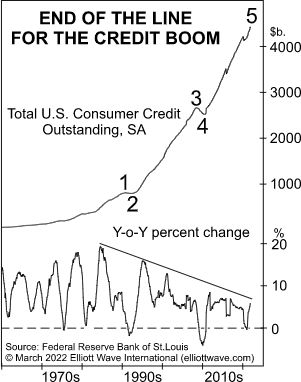

Looking at the big “credit” picture, the Elliott wave model suggests that the historic “credit boom,” which has been in the making for decades, is either at or nearing a peak. The completion of five waves indicates the trend turn.

Here’s a chart and commentary from the March Elliott Wave Financial Forecast:

The chart suggests the economy is on shakier ground than economists suspect. Total U.S. consumer credit outstanding includes credit card debt, personal loans, auto loans, and student loans. It does not include mortgages, which is somewhat remarkable considering how closely its rise resembles that of home prices. Clearly, home prices and consumer credit levered the rising social mood of Cycle wave V extremely well. Since it sports the same look as home prices, however, consumer credit faces a similar reversal. As The Socionomic Theory of Finance explains, the form of the rise is five waves because “credit trends are socionomically regulated.” This means that in a bull market, as creditors and debtors “cooperate with each other, loans balloon to a high level. The ensuing, natural trend toward negative social mood, at whatever point it begins, induces pessimism, which motivate lenders to call in loans and participants in the economy to curtail expansionary activity.”