Here Are the Likely “Key Players in the Next Financial Crisis”

During the 2007-2009 subprime mortgage meltdown, the global financial system faced the fear of what was termed a “financial Armageddon.”

Big financial institutions like Lehman Brothers, Bear Stearns, AIG, Washington Mutual and others collapsed.

Here in 2021, consider this Bloomberg headline from September:

JPMorgan Stakes Its Own Capital on Record European Junk Bond Bet

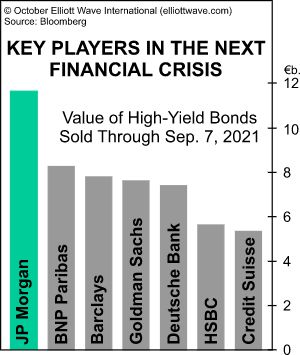

Elliott Wave International’s monthly Global Market Perspective provided a warning by showing this chart and saying:

At this point, the world’s largest investment banks have joined bondholders on the financial precipice. The chart at right illustrates the value of high-yield bonds sold by the largest investment banks from January 1 through September 7. According to Bloomberg, JP Morgan has never before in history committed as much of its balance sheet to European junk bonds. Through early September, the U.S. investment bank had underwritten a record 43 deals, “upping the ante even as strategists … warn that euro credit markets have become over-priced.” (Bloomberg, 9/7/21) Meanwhile, the bank’s bridge loan book (short-term loans that span financing gaps during takeovers) has pushed to its highest level since the 2008 financial crisis.

These dangers, too, are difficult to fully appreciate. When banks underwrite loans, they essentially promise investors an agreed-upon rate of interest. Then they eat any losses that arise when bond auctions fail to go as planned. The dynamic with bridge loans is even more dangerous, as investment banks lend money to the acquiring company under the assumption that they will get repaid with cash from the acquired company. Both of these assumptions will get tested mightily in the years ahead.