Honk if You’ve Fallen Behind on Your Car Payment

If that were a bumper sticker and motorists complied with its request, there’d be quite a bit of honking heard on the roadway.

Yes, increasing numbers of people are not making their car payments on time.

Here’s a Feb. 4 CNBC news item:

The share of borrowers who are 60 or more days behind in their auto loan payments was 26.7% higher in December than it was a year earlier.

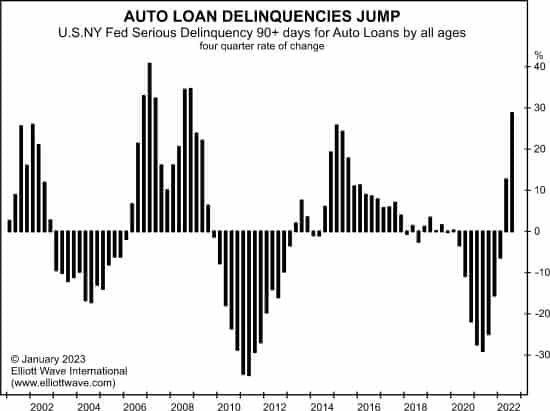

Relatedly, the January Elliott Wave Theorist showed this chart and said:

Households are suddenly having difficulty making car-loan payments, as shown in [the chart]. With new and used car prices at all-time highs, people have likely taken on more debt than they can handle.

As a side note, that issue of the Theorist provides an even broader perspective on debt:

Household debt has risen to $16.5 trillion. Most of it is mortgages; some is auto loans; the rest is credit-card debt. The Fed has created $9 trillion since its founding in 1913. So, households owe 1.8 times as many dollars as dollars exist.

The anticipated contraction of this debt will spell deflation.