Housing Bubble “Slowly Deflating” in the “Land Down Under”

Housing prices have soared in many global hot spots, including Australia.

However, a reversal appears to be in the making, especially in two of the nation’s largest cities. Here’s an April 2 Reuters headline:

Australia housing bubble slowly deflating as heat leaves Sydney, Melbourne

Specifically, February to March, home prices fell 0.2% in Sydney and slipped 0.1% in Melbourne.

Another global market where there’s been a housing boom is the U.S.

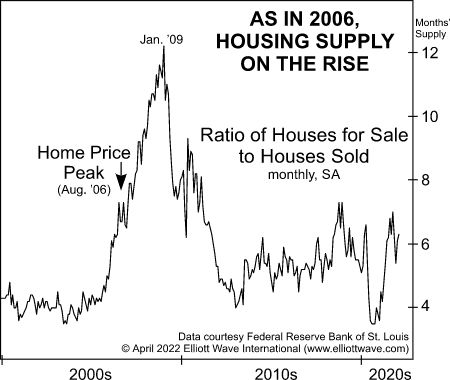

Yet, at this juncture, the supply of housing has been rising. Elliott Wave International’s April Global Market Perspective provides a historical with this chart and commentary:

Housing booms always decrease housing inventories. As they reach exhaustion, supply creeps higher, which it is now doing, just as it did prior to the August 2006 peak. As the chart shows, at 6.3 months of supply, the ratio of houses for sale to houses sold is comparable to August 2006, when it was 6.9 months of supply. The record ratio of 12.2 came in January 2009. It should be exceeded before the next real estate price decline concludes.

So, it appears that the “deflation” of a housing bubble extends beyond Australia.