Insights into Britain’s “Austerity 2.0”

The phrase “era of austerity” is back in Britain (Nov. 15, CNBC):

British government to usher in new era of austerity in effort to restore market confidence

I say “back” because, as you may recall, the phrase was widely used during the early days of the 2007-2009 financial crisis. The re-introduction of “era of austerity” in the latter part of 2022 may be an omen of what’s ahead.

Indeed, many observers of Britain’s economy believe that a recession, and a prolonged one at that, is already in the cards (Dec. 8, The Times):

Investors pull £1bn from UK-focused funds ahead of recession

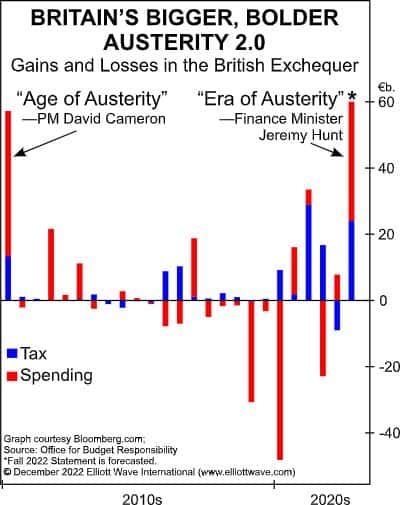

Elliott Wave International’s December Global Market Perspective mentioned Britain’s new era of austerity. The commentary is below this chart:

In November, finance minister Jeremy Hunt told the BBC, “We are going to see everyone paying more tax. We’re going to see spending cuts.” The idea is to plug the holes in the country’s finances and to restore public confidence, but, as in 2009, government policy is entirely dependent on the dominant social mood trend. According to this chart, authorities once again anticipate windfall inflows to the British Exchequer, but the most radical austerity measures won’t take effect until after the next general election in 2025. By then, stock prices should be much lower, and austerity will simply be an unavoidable part of everyday life.