Insights into the Deflation of “Risk Bubbles”

You can call them asset classes or financial markets. Some describe them as “risk bubbles.”

This latter phrase is what Bloomberg chose to use in this January headline:

Risk Bubbles Are Deflating Everywhere, Some Market Watchers Say

Bubbles in crypto, high-growth tech stocks are ‘popping’: BofA

Back in November, The Elliott Wave Theorist provided a warning for an even longer list of assets that have been due to deflate:

No stock market has ever been so absurdly overhyped and overowned. The same is true for junk bonds, real estate, cryptocurrencies and digital art. It is a unique era.

And, speaking of tech stocks (mentioned in the Bloomberg quote), the January 7 Elliott Wave Financial Forecast provided this insight:

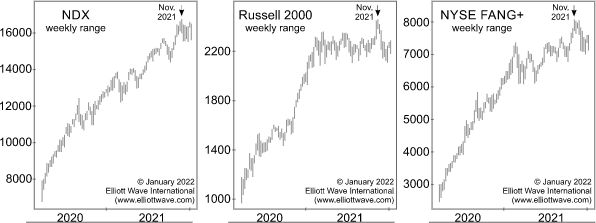

You may not realize it from reading the headlines, but the NASDAQ indexes, the Russell 2000 index and the FANG+ Index all failed to accompany the Dow and S&P to this week’s highs. While the NASDAQ closed yesterday 6% below its closing high on November 19, nearly 40% of the index’s firms have plunged by at least half from one-year highs, a near-record number (Bloomberg 1/6).

These three charts were among many others that were shown in the January EWFF. Notice that these indexes topped in November.