Japan’s Prime Minister Wants Next BOJ Head to Focus on Beating Deflation

Japan’s repeated efforts to defeat deflation has been going on for roughly three decades.

And, now, Japanese Prime Minister Fumio Kishida is looking ahead to April 2023 – when the current Bank of Japan Governor Haruhiko Kuroda’s term ends.

Here’s a quote from a March 4 Reuters article:

Japan’s next central bank governor should be someone who understands the need to work with the government in beating deflation, Prime Minister Fumio Kishida said on [March 4].

So far, Japan has fallen short of reaching its 2% inflation target despite the central bank’s stimulus efforts.

Robert Prechter’s 2021 book, Last Chance to Conquer the Crash, provided this perspective:

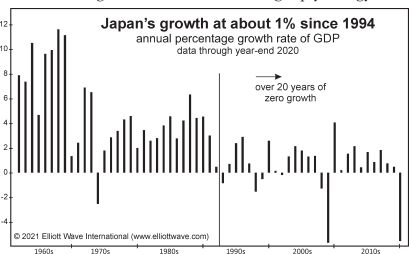

Japan had one of the strongest economies in the entire world, growing at a 9% rate for 20 years up to 1973, and then a pretty strong rate of about 4.5% through 1994. From there, it’s averaged about 1%.

The reason Japan is in trouble was expressed in a November 1, 2012 headline from MarketWatch: “Japan Is in Worse Than a Deflationary Trap.” But it’s not worse than a deflationary trap. It’s just a deflationary trap. Here’s what the article says: “Policy makers have spectacularly failed. Brutal deflation persists. Japanese officials tried monetary stimulus, including zero interest rates and quantitative easing.” Does that sound familiar? And here: “Past fiscal stimulus has ballooned the national debt to 200% of GDP.” Does that sound familiar, too? And finally, “The most troubling aspect of Japan’s malaise may be psychological.” That’s the key to the whole thing. When social mood changes psychology from ebullience to conservatism, a trend of expanding credit shifts to a trend of declining credit and therefore inflation into deflation.