Major Bank Warns of Economic “Shock”

Get ready for a recession.

At least, that’s the message from one of the nation’s largest financial institutions.

Here’s an April 11 headline from Fox Business:

A ‘recession shock’ is coming to the US, Bank of America says

The article goes on to say that economists at Bank of America expect an economic downturn to result from the Fed’s gung-ho stance (raising rates) to get inflation under control.

Yet, Elliott Wave International has shown time and again that the market leads on rates and the Fed follows. More than that, Elliott Wave International anticipated higher rates well before these latest worries about a hawkish Fed.

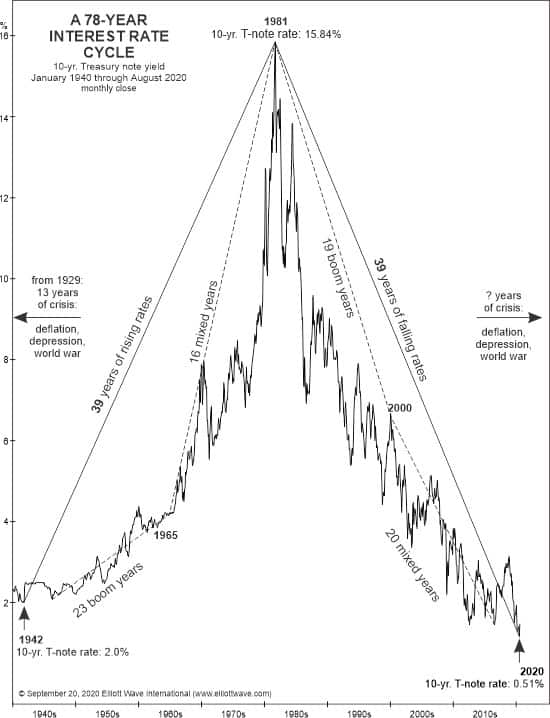

As far back as Sept. 23, 2020, The Elliott Wave Theorist showed this compelling chart and said:

[The chart] depicts a 78-year history of the interest rate on the U.S. government’s 10-year notes. The 39 years of rising interest rates from 1942 to 1981 preceded 39 years of falling rates from 1981 to 2020. In some areas of the world in recent years, interest rates went negative, for the first time in history and maybe the last time in history—or at least a few centuries. Interest rates likely bottomed in March, which means bond prices have begun a significant fall. The change will occur most dramatically on lower-quality debt, but it will eventually spread to higher-quality debt such as depicted here.

Indeed, U.S. government bond prices have been trending lower (with yields surging higher) since this issue of the Theorist published.

As you probably know, bond prices and yields move inversely to each other.