Major Headwinds for China’s Economy

In a teleconference on May 26, Premier Li Keqiang of China implored local government officials to do all they can to shore up China’s economy.

Here’s a May 26 Washington Post headline:

‘No time to lose’: Top Chinese official sounds alarm over economy

Li mentioned the coronavirus and the war in Ukraine as just two factors which pose challenges to the world’s second largest economy.

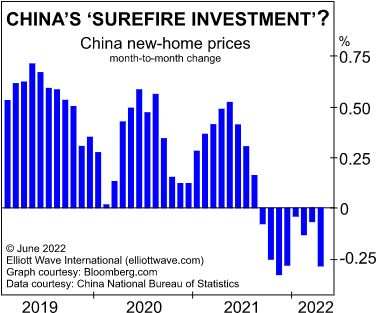

The June Elliott Wave Financial Forecast also discusses China’s housing market. Here’s a chart and commentary:

On May 20, news headlines marked another “role reversal” of historic proportions. For the first time since 1976, China’s economic growth is expected to be less than that of the United States. This is not a positive development. China’s rise to become the world’s second biggest economy is a consequence of the Great Bull Market, and its recent retreat is one of the more prominent expressions of the emerging bear market’s progress. This is why the Elliott Wave Financial Forecast has paid such close attention to the Chinese property market. As the chart shows, month-to-month prices of China’s new-home sales turned negative in September, and they’ve continued to fall since. The year-over-year average of new home prices also fell in April. It was the first such decline since November 2015. The declines “have shaken a core belief among many in China that buying a home is a surefire investment.” Of course, these are official government figures, so they are subject to the machinations of the Chinese Communist Party. The sales at Chinese property developers tend to be a more reliable indicator of the real estate market’s true health. According to The Wall Street Journal, year-over-year sales by China’s top 100 developers turned negative in July 2021, falling 8.3%. Since then, the decline increased every month, reaching 58.6% in April. The volume of land sales by cities is another dependable Chinese property market indicator. In the first three months of the year, land sales in 300 Chinese cities fell 60% from the first quarter of 2021.

The weakness is now spreading throughout China’s economy, as April 2022 industrial production declined 2.9% compared to April 2021. Retail sales fell 11.1%, and car purchases declined 35.5%.