Recession: The Handwriting is on the Wall

Who to believe – those who predict a recession or those who say a recession will be avoided?

A Bloomberg recession probability model prompted this headline back in mid-October (Bloomberg, Oct. 17):

Forecast for US Recession Within Year Hits 100% …

On the other hand, as we kick off the final month of the year, a different news item says otherwise (CNN, Dec. 1):

Inflation is cooling. Consumers are still spending. And hiring is slowing — but not collapsing. That’s why [a] chief economist … is increasingly confident that the American economy will — narrowly — escape a recession.

Well, in Elliott Wave International’s view, the handwriting is on the wall. Here’s a chart and commentary from the December Elliott Wave Financial Forecast:

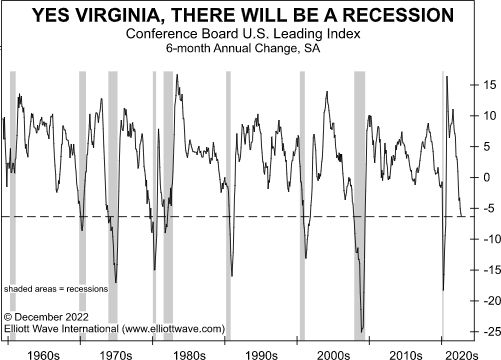

An economic depression is closing in. The Elliott Wave Financial Forecast’s main reference point for this ongoing forecast is the stock market, which is the best leading indicator for the economy. There are other useful indicators. The Conference Board’s Leading Economic Index combines the trend of the S&P 500 with nine other economic variables. We’ve discussed some of these measures in recent issues, with updates on housing and credit conditions and the inverted yield curve in this issue. Other inputs include the ISM Index of New Orders, Average Weekly Manufacturing Hours and New Orders for Manufacturing and Consumer goods. As the chart shows, the Conference Board LEI has been plunging. In October, the six-month annual change dropped to minus 6.3. As the dashed line indicates, similar readings slightly preceded or accompanied all eight economic recessions since the 1960s. The first leading datapoint of November hit the wire yesterday morning. Last month, the ISM Manufacturing Index slid to 49 from 50.2. After falling for five of the past six months, the measure is now below 50, the threshold separating expansion from contraction. It is the first signal of contraction in this indicator since May 2020.