Sales of Newly Built U.S. Homes Lose Some Sizzle

In November, sales of newly built U.S. homes were down 14% from a year ago.

With that in mind, a Dec. 23 CNBC article says:

[H]istorically prices lag sales by about six months, and sales are coming down.

Elliott Wave International agrees that the trend in home prices tends to follow the trend in home sales – not only in the U.S., but elsewhere.

For example, the October Elliott Wave Financial Forecast discussed China’s real estate market:

The average new home price in 70 Chinese cities fell 0.1% in September. As we’ve been saying, a decline in home sales leads to a decline in prices, and land and home sales are now falling by larger and larger amounts. In September, major real estate developers reported declines of 24% to 34% in one-year home sales.

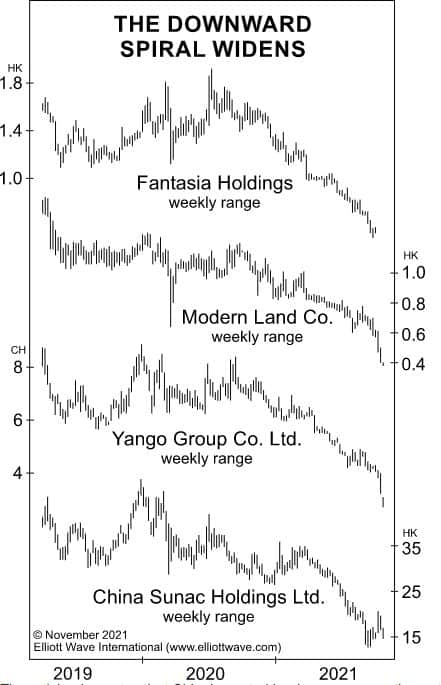

The same issue of the Financial Forecast showed this chart and continued with this commentary:

Once the shares [of China Evergrande] started to trade again on October 21, the stock price resumed its inexorable decline. It now has lots of company. The shares of most Chinese property developers are plumbing new depths. This chart shows a freefall in four companies: Fantasia Holdings (where trading is suspended), Modern Land Co. (where trading is suspended), Yango Group and China Sunac Holdings, which are down 63%, 68%, 70% and 71% respectively from the beginning of 2020.