Slow U.S. Car Sales Ominous for Economy

Many U.S. motorists are saying: “The car I have now will do just fine.”

Indeed, these motorists are keeping their cars longer than ever. S&P Global Mobility recently stated that the average U.S. vehicle hitting the highways is 12 years and 2 months old. That’s the highest number in the more than 20 years the data has been tracked.

Related, a June 14 Fox Business sub-headline says:

Total US vehicle sales projected for 13.1 million transactions in 2022, falling below 17 million average

As you might imagine, this does not bode well for the economy.

The monthly Elliott Wave Financial Forecast has been ahead of both developing stories – the U.S. car market and the economy.

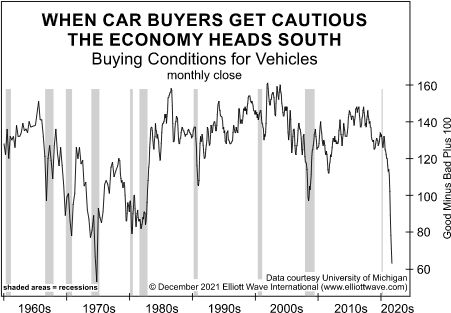

Here’s a chart and commentary from the December 2021 issue:

The chart … shows buying conditions for vehicles from queries issued by the University of Michigan’s monthly consumer sentiment survey since the mid-1950s. Since the mid-1960s, a decline in consumers’ view of car buying conditions invariably preceded every economic contraction. The measure has never experienced a more dramatic plunge than in recent months. Economic headwinds are likely much closer than economists realize.

This warning about the economy was prescient. U.S. GDP contracted by 1.5% in Q1 2022.