The Deflation of European Housing Prices Persists

In Q4 2022, home prices across the European Union slid 1.5% from the prior three-month period.

It appears the decline is not over.

Home prices in some European nations have been hit harder than others. Sweden is a case in point.

Here’s a May 2 Bloomberg headline:

Sweden’s Housing Downturn Deepens, With More Declines Forecast

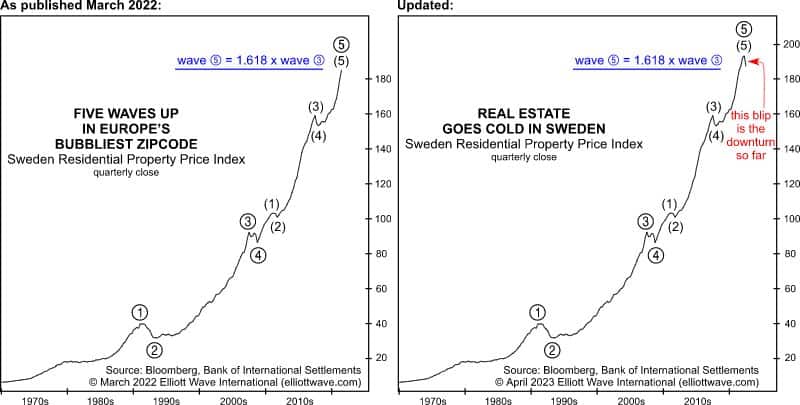

Elliott Wave International’s Global Market Perspective was ahead of this development. Here are two side-by-side charts from the April issue.

The Elliott wave case continues to point to a generational top in prices. In fact, a full year has passed since we illustrated an ending fifth-of-a-fifth wave up in Sweden’s Residential Property Price Index (left chart). You can barely see it, but that blip on the far-right side of the updated chart represents the sell-off to date. According to the experts, the downturn is pretty much over already. “The National Institute of Economic Research recently adjusted its forecasts to a more shallow dip in house prices, now seeing a drop of between 15% and 20%.” (CNBC, 4/6/23)

Nothing is impossible, but many of the precursors for a broader property bust are still gathering strength.