The Demand for Cash is Rising

One sign of a developing deflationary psychology is a rising demand for cash.

Look at this March 15 Yahoo! Finance headline:

Investors are beginning to hoard cash on recession fears: BofA

This is quite in contrast with the actions of money managers as recently as October 2021.

Then, the Elliott Wave Financial Forecast showed this chart and said:

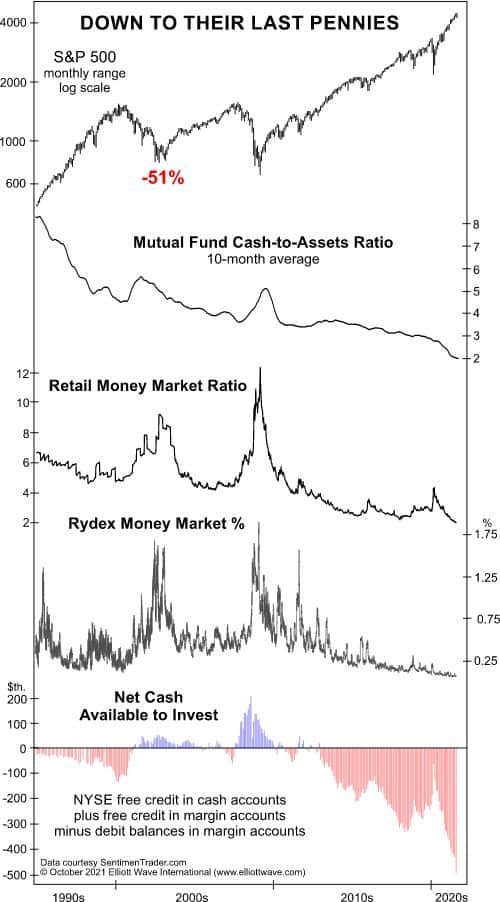

When the 10-month average of the U.S. mutual fund cash-to-assets ratio fell to 4.6% in March 2000, EWFF cited the “utter contempt for cash” as a clear sell signal and forecasted a quick shift when “Cash is king.” As the chart shows, the S&P 500 declined 51% over the next 31 months. … When it comes to cash, the ultimate safety net, investors have never been stretched as thin as they are now. At 2.02 %, for instance, the 10-month average of cash-to-assets held by mutual fund managers is—incredibly—less than half of what it was at the end of the dot.com mania in 2000. The third graph on this chart shows the Investment Company Institute’s ratio of cash in money market funds as a percentage of S&P market capitalization (the Retail Money Market Ratio). The latest reading of 2% is the lowest in the 41-year history of the data. According to Rydex’s mutual fund data, a historic disdain for cash continued through much of September. … Back in January 2020, when the Rydex money market holdings dropped to 0.10% ten times in one month, EWFF stated, “The bullish imperative is the most persistent yet.” The next big move for the S&P 500 was a 35% decline to March 23, 2020. The current situation is even more extreme.

The bottom graph shows another unprecedented exposure to equities. The Net Cash Available to Invest figure subtracts liabilities or margin debt held by investors at New York Stock Exchange member firms from free credits, which are essentially the same as cash. The biggest net deficits generally come at stock market highs. The latest figure for August is -$493.3 billion, a record. The deficit is more than 3.7 times that which occurred at the March 2000 peak.

Just three months later, the S&P 500 hit an all-time high on Jan. 4, 2022.

Also, keep in mind that the value of cash rises during deflation. So, getting back to that March 15 Yahoo! Finance headline, those investors hoarding cash are likely taking a wise step in preparation for the future.