The Issuance of SPACs Gets Smacked

When social mood transitions from positive to negative, investors interest in an array of financial assets begins to wane.

Consider Special Purpose Acquisition Companies (SPACs), which are initial public offerings that raise money with the intention of acquiring an as-yet unidentified firm or firms. This is why these investment vehicles are also known as “blank-check” offerings.

The speculative fervor that had surrounded SPACs has simmered down – way down.

Here’s an August 3 CNBC headline:

SPAC market hits a wall as issuance dries up and valuation bubble bursts

The Elliott Wave Financial Forecast has repeatedly warned that the SPAC market would deflate.

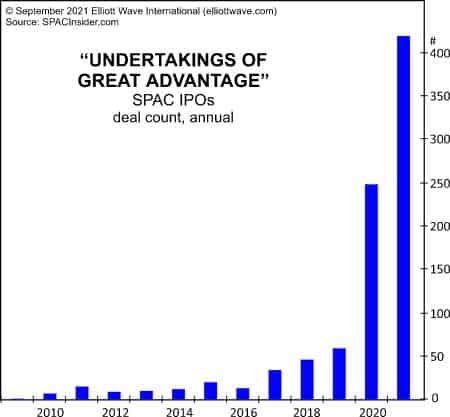

Indeed, as far back as September 2021, the monthly publication provided historical context when it showed this chart and said:

Blind pools are nothing new. They originated in England about 280 years ago. The first known blind pool included a statement in the prospectus offering shares “of a company for carrying on an undertaking of great advantages, but nobody to know what it is.” They also surfaced in America during the stock market boom of the 1920’s.

This history links blind pools with the onset of two of the most important bear markets over the past 300 years: the Grand Supercycle bear market of the mid-1700s and the Supercycle wave (IV) bear market of 1929-1932, which ushered in the Great Depression. Apparently, there’s just something about the last moments of the biggest bull markets that attracts investors to investments that are, by design, lacking in transparency.

… So far [in 2021], 419 SPAC IPOs took in $122.8 billion in proceeds; the chart shows the meteoric rise from just one SPAC deal in 2009.