This New ETF Aims to Protect Against Deflation

Do you fear that the U.S. is headed for a deflationary scenario akin to what Japan has been going through?

If so, as the saying goes, “there’s an ETF for that.”

Here’s an excerpt from a Sept. 21 Bloomberg article headlined “Nancy Davis Flips to Deflation in New ETF After $3 Billion Haul”:

Nancy Davis has lured billions to her ETF guarding against inflation. Now she’s looking to repeat that success with a product betting on the other side of the trade.

Her firm, Quadratic Capital Management LLC, is launching the Quadratic Deflation exchange-traded fund (ticker BNDD), it said in a Tuesday statement.

The new product will seek to profit in an economic climate of falling prices, weak growth and negative long-term interest rates. Like its established sibling with the opposing mandate — the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL) — the strategy aims to deliver by trading a mix of Treasuries and options.

“Some investors have expressed concerns that the U.S. will experience an environment similar to Japan given the debt increase and labor market,” Davis, who will manage the new strategy herself, said in the statement. “It’s prudent for investors to have tools available to them so that they are prepared for a wide range of economic outcomes and environments.”

Markets have been fretting over inflation for months on the risk that price pressures could prove less transitory than the Federal Reserve expects. Yet as key measures of reflation ease from multi-year highs, Quadratic is betting investor attention will return to the long-term deflationary forces of the pre-pandemic world.

Of course, no one knows how a particular exchange-traded fund or any other investment will perform.

Yet, Robert Prechter does mention a “safe asset” that “assuredly rises in value during deflation” in his book, Conquer the Crash (2020 edition):

Today, few people give cash a thought. Because interest rates on Treasury bills are “too low,” investors claim that they have “no choice” but to invest in something with “high yield” or “upside potential.” Ironically but obviously necessarily, the last major interest-rate cycle was also perfectly aligned to convince people to do the wrong thing. In the early 1980s, when rates were high, people thought that stocks were not worth buying. Now that rates are low, they think that T-bills are not worth holding. It’s a psychological trap keeping investors from doing the right thing: buying stocks at the bottom (when rates were high) and selling them at the top (when rates are low).

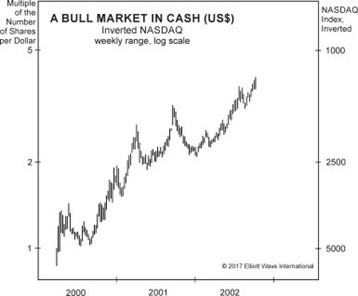

Now let’s dispose of the idea that the return on cash is always “low.” … [The chart below] is one picture of the rising value of cash in the United States, which appreciated 287 percent from March 2000 to October 2002 in terms of how many shares of the NASDAQ index it could buy.

Wouldn’t you like to enjoy this kind of performance, too? You can, if you move into cash before a major deflation. Then when the stock market reaches bottom, you can buy incredibly cheap shares that almost no one else can afford because they lost it all when their stocks collapsed.

Cash is the only asset that assuredly rises in value during deflation.

Also, in Japan, the value of cash appreciated 400% in terms of how many shares of Japanese stocks it could buy from 1990 through 2008.