U.S. Consumer Debt Climbs to an All-Time High

As we’ve discussed before in these pages, the one factor that prior episodes of deflation have in common is an unsustainable buildup of debt.

With that in mind, consider this Sept. 26 news items from Bloomberg:

Consumer Debt Hits Record for Most Americans, Except the Wealthy

Liabilities for bottom 90% jumped $300 billion over past year

The inability of many people to pay back their loans will likely result in widespread defaults.

Earlier this year, in March, The Elliott Wave Theorist noted:

In boom times, banks become imprudent and lend to almost anyone. In busts, they can’t get much of that money back due to widespread defaults. That is a rare thing, which is why deflation is a rare thing.

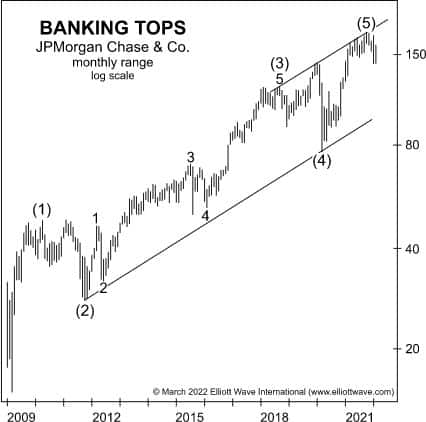

In the same month, The Elliott Wave Financial Forecast provided this perspective. Here’s a chart and commentary:

With the help of supplemental indicators such as … the five-wave form of JPMorgan Chase’s stock chart, the socionomic case for a new era of defaults is even stronger. In time, the new negative mood will make it impossible for some consumers to repay what they owe. Eventually, the most affected banks will fail. As financial survival becomes an open question, financial stocks across the board will reflect the uncertainty.