U.S. Consumers Cut Back on Spending, Economic Growth Hurt

Consumer spending comprises 69% of the $23.2 trillion U.S. economy.

So, it’s not surprising to see a deceleration in U.S. economic growth when consumers significantly cut back on spending.

And, in Q3, that’s what happened.

Here’s an excerpt from an Oct. 28 CNBC article:

The U.S. economy grew at a 2% rate in the third quarter, its slowest gain of the pandemic-era recovery … the Commerce Department reported Thursday.

Gross domestic product, a sum of all the goods and services produced, grew at a 2.0% annualized pace in the third quarter, according to the department’s first estimate released Thursday. Economists surveyed by Dow Jones had been looking for a 2.8% reading.

That marked the slowest GDP gain since the 31.2% plunge in the second quarter of 2020.

Declines in residential fixed investment and federal government spending helped hold back gains, as did a surge in the U.S. trade deficit. …

The drops mostly offset increases in private inventory investment, a meager gain in personal consumption, state and local government spending, and nonresidential fixed investment.

Consumer spending … increased at just a 1.6% pace for the most recent period, after rising 12% in the second quarter.

This slowdown in consumer spending is not surprising to readers of The Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets.

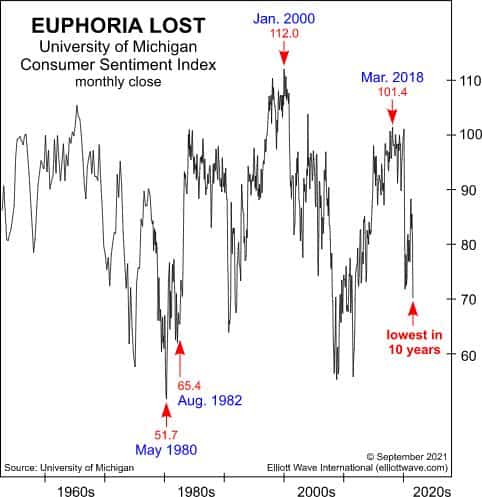

Here’s a chart from the September 2021 issue, which was shown in these pages some weeks ago. It’s fitting to show it again. The accompanying commentary is below the chart:

The consumer is clearly out of sorts with the financial optimism of the day. The arrows on the chart highlighting the low in 1980 and the low in August 1982, the orthodox end of Cycle wave IV, show that consumer sentiment led the way out of an economic quagmire at the beginning of Cycle wave V. Now, at the end of wave V, they are even more dramatically leading the way into a new one.