U.S. Household Debt Surpasses This Milestone Level

A study of past deflationary episodes reveals that all were set off by unsustainable debt levels.

With that in mind, look at this Nov. 9 CNBC headline:

Household debt total passes $15 trillion for the first time

Corporate debt has also been climbing.

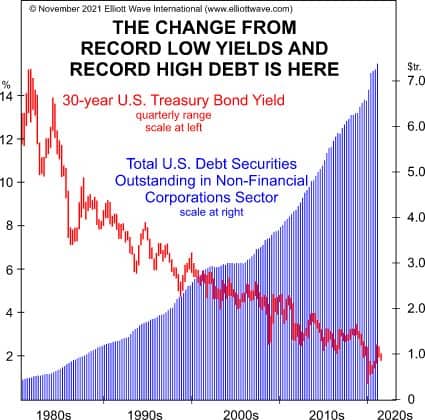

Here’s a chart and commentary from the November Elliott Wave Financial Forecast:

The chart shows that a 39-year bull market in U.S. Treasury long bonds that led to a record-low yield of 0.7% on March 9, 2020 coincided with a historic rise in total corporate debt levels. The optimism that generated the bull market in bonds also permitted companies to gorge on debt, with their confidence remaining sky high that the availability of cheap credit will continue and the cost to service it will remain low. The trend in yields, however, reversed in March 2020. …

A bear market in stocks will eventually suction away financial liquidity, at which point bond defaults should soar.