Why the 1.4% Decline in GDP Should Be No Surprise

An April 28 CNBC headline says:

U.S. GDP fell at a 1.4% pace to start the year as pandemic recovery takes a hit

This annualized drop in GDP in Q1 is a surprise to some professional observers of the economy.

That CNBC article goes on to note that the negative GDP figure is “below analyst expectations of a 1% gain.”

However, analysts at Elliott Wave International are not surprised.

The reason why is that the broad U.S. stock market has already topped (for example, the Dow Industrials peaked in early January).

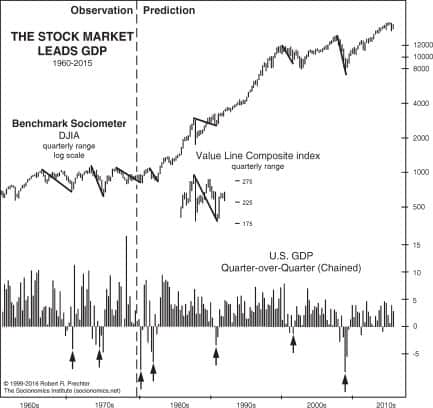

This chart and commentary from Robert Prechter’s landmark book, The Socionomic Theory of Finance, provide insight:

The stock market leads GDP. As the stock market fell in Q1 1980 and again in 1981-1982, back-to-back recessions developed. As the stock market rose from 1982 to 1987, an economic boom occurred. After stock prices went sideways to down from 1987 to 1990, a recession developed. As stock prices resumed rising, the economy resumed expanding. As the stock market fell in 2000-2001, a recession developed. As the stock market recovered in 2002-2007, an economic expansion occurred. As the stock market fell in 2007-2009, a recession developed, and it was commensurate with the size of the drop: The largest stock market decline since 1929-1932 led to the deepest recession since 1929-1933. As the stock market has recovered since 2009, an economic expansion has developed. In all cases but one, the stock market either turned down before the recession began or turned up before the expansion began. The lone exception was in 2002, when the Dow made a new low after the official end of the recession in 2001. Data show that a setback in GDP growth into that later bottom just barely missed creating a recessionary quarter. (It is important to understand that socionomic causality does not predict that each stock market decline will produce an official recession as defined by the NBER; it predicts that stock market declines and advances will reliably lead rather than follow whatever official recessions and recoveries do occur.