Worker Productivity Substantially “Deflates” in Q1

U.S. nonfarm productivity is a measure of output against hours worked and it took a historic tumble in the first three months of the year.

This May 5 CNBC headline sums it up:

Worker output fell 7.5% in the first quarter, the biggest decline since 1947

This “deflation” in worker productivity ties in with what Robert Prechter wrote in his book, Last Chance to Conquer the Crash:

Economic contractions used to come in different sizes. Economists specified only two, which they labeled “recession” and “depression.” In 2009, they added a new term to the lexicon: “great recession.”

Based on how economists have applied these labels in the past, we may conclude that a recession is a moderate decline in total production lasting from a few months to two years. A depression is a decline in total production that is too deep or prolonged to be labeled merely a recession. As you can see, these terms are quantitative yet imprecise. They cannot be made precise, either, despite misguided attempts to do so. [emphasis added]

For the purposes of this book, all you need to know is that the degree of the economic contraction that I anticipate is too large to be labeled a “recession” such as our economy has experienced thirteen times since 1933.

Also keep in mind that U.S. GDP fell 1.4% in Q1. This should not be a surprise given the Dow Industrials and S&P 500 index topped in January.

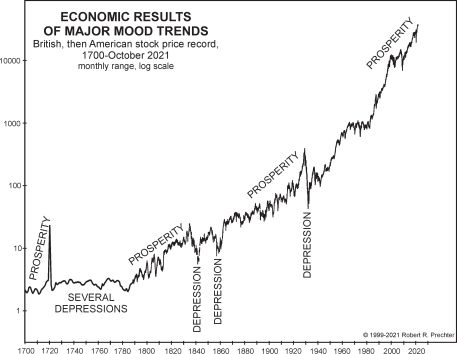

Another quote (and chart) from Last Chance to Conquer the Crash provide insight:

If you study [the chart], you will see that the largest stock-market collapses appear not after lengthy periods of market deterioration indicating a slow process of long-term change but quite suddenly after long periods of rising stock prices and economic expansion. A depression begins, then, with the seemingly unpredictable reversal of a persistently, indeed often rapidly, rising stock market. The abrupt change from increasing optimism to increasing pessimism initiates the economic contraction.