Worries over the economy have many young adults in China embracing a penny-pinching mindset.

As an Oct. 1 Fortune headline says:

China’s millennials and Gen Z are falling out of love with consumerism and fueling a new ‘frugal living’ social media movement as reality bites

One group called “Crazy Money Savers” is on a Chinese website and the group has over 600,000 subscribers.

The October Elliott Wave Financial Forecast says this frugality in China is a deflationary development and mentions another entity devoted to saving money:

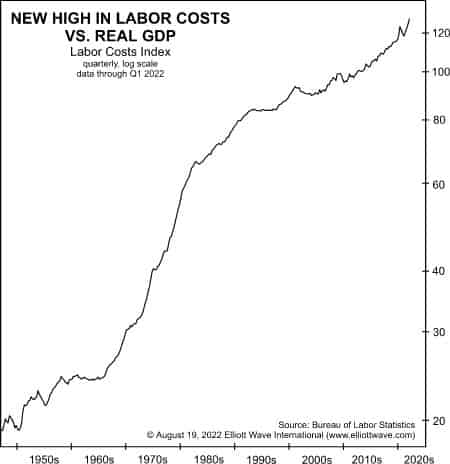

With average salaries falling, “young people prefer to save than splurge.” Popular social media posts show viewers how to make 10-yuan ($1.45) dinners and live off $1600 yuan a month. A new entity called the Low Consumption Research Institute has 150,000 members. It’s founder “is cutting spending and selling her belongings on second-hand sites to raise cash.” According to a People’s Bank of China study, 60% of Chinese say “they are now saving more rather than spending,” which is up from 45% in 2019.

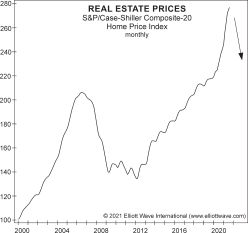

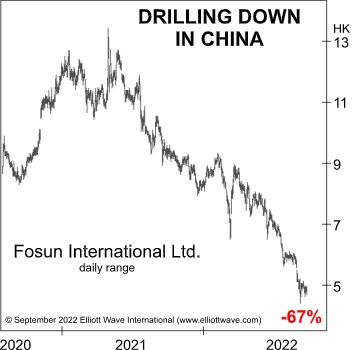

Recent Elliott Wave Financial Forecast issues have covered other Chinese social changes that are consistent with a new bear market order, such as a mortgage boycott, which continues to spread. According to Reuters, in mid-September, potential Chinese homebuyers are boycotting payments on 343 real estate projects under construction, up from 318 in July. They are also “ratcheting up their demands.” Some developers and cities are trying to quell the unrest with window dressing efforts to re-start stalled projects, but future homeowners are adamant about a return to full construction. One would-be homeowner said, “If we don’t see material results, we’ll go to Beijing.” In March, the Elliott Wave Financial Forecast discussed the “lie flat” movement in which young Chinese “opt out of the struggle for workplace success” and adopt an “indifferent attitude toward life.” The movement, known in Chinese as “tang ping,” became popular in 2021. In March 2022, another Chinese term emerged, “bai lan,” which translates to “let it rot.” Bai lan is “a more negative term,” explains a Shanghai sociology professor. “Bai lan is where young people refuse to put further efforts [in life] because they just can’t see any hope in doing so.” CNBC points out that the “anti-hustle mentality” is the “antithesis of success in China.” Wikipedia calls the movements “the Chinese equivalent of the Hippie counter-culture,” which coincided with the end of Cycle wave III in the late 1960s. In case you forgot, that time saw the onset of a 16-year bear market in the real value of U.S. stocks.