U.S. Auto Sales: Here’s What the Slowdown Portends

Car and truck commercials have been a mainstay on national and local television for decades.

So, you don’t have to be an economist to know that the automobile industry is a key part of the U.S. economy.

However, sales have declined in Q1 versus a year ago.

Here’s an April 1 U.S. News headline:

U.S. Auto Sales Fall in Q1 …

Indeed, General Motors reported on April 1 that its sales were down 20% for the quarter. Nissan’s sales tumbled 30% and Honda’s sales fell 23%. Toyota saw a 15% decline.

This is no surprise to Elliott Wave International.

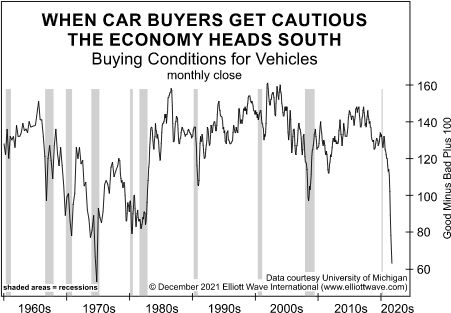

Even before Q1 kicked off, the December 2021 Elliott Wave Financial Forecast showed this chart and said:

Demand for cars appears to be a thing of the past. This chart suggests consumers are souring on the whole idea. It shows buying conditions for vehicles from queries issued by the University of Michigan’s monthly consumer sentiment survey since the mid-1950s. Since the mid-1960s, a decline in consumers’ view of car buying conditions invariably preceded every economic contraction. The measure has never experienced a more dramatic plunge than in recent months. Economic headwinds are likely much closer than economists realize.