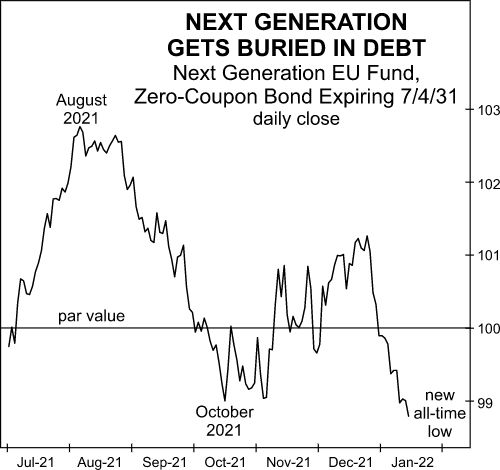

Is Insolvency Ahead for the Next Generation EU Fund?

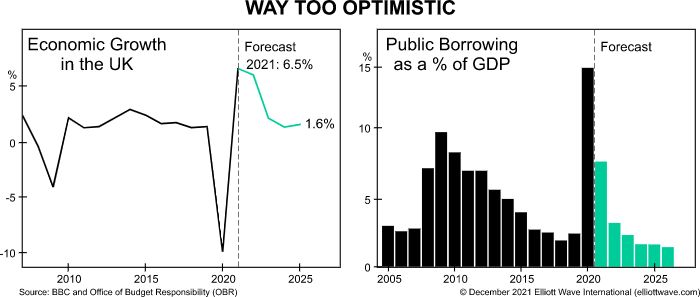

In the wake of the COVID-19 crisis, an €800 billion debt facility was created to prevent Europe from repeating the aftermath of the 2008 global financial crisis.

This debt facility is called the Next Generation EU fund.

Recently, some business executives have expressed dismay over the way the funds are being handled.

Here’s a Jan. 19 headline (EURACTIV):

Spanish CEOs worried about good management of EU Next Generation funds

However, those who manage the Next Generation EU fund may face even bigger problems than fielding complaints from CEOs. Here’s a chart and commentary from Elliott Wave International’s January Global Market Perspective:

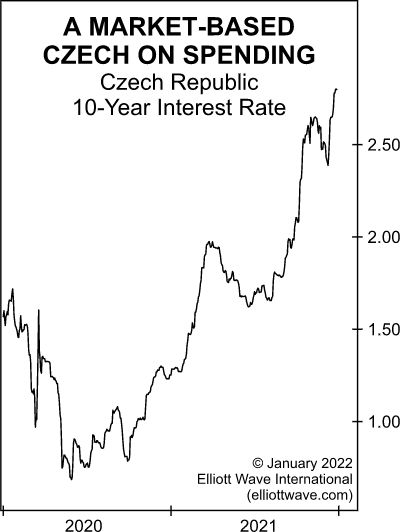

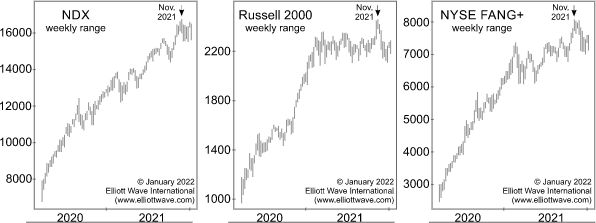

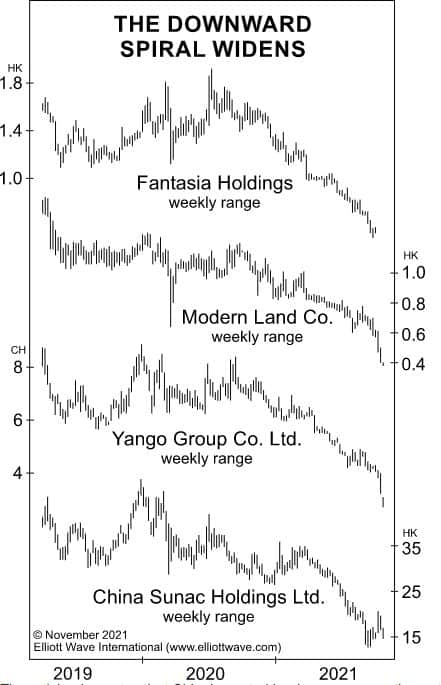

A new bear market will drain the EU’s coffers, and the resulting negative mood trend will cause investors to question the very solvency of the pandemic fund. On this point, the price of these bonds is illustrative. After issuance near par in July 2021, prices jumped 4% and peaked at an all-time high on August 4, 2021. Prices then fell for two months, bottomed on October 12 and underwent a countertrend rally that petered out in December 2021. As we go to press, the bonds just sunk to a new all-time low. Given the sheer mountain of shaky debt that exists across the EU, it’s hard to overstate the negative economic impacts of a long-term trend toward rising interest rates. What we can say with confidence is that because the Next Generation fund is supranational — essentially relying on cooperation among EU nation states — a bear market in bonds should hit the facility especially hard.